what months are property taxes due

Secured property tax bill first installment. Second installment of taxes for property assessed on the secured roll must be paid by 5 pm.

Payment Of Texas Property Taxes And Past Due Options

What months are property taxes due.

. On January 1 every year the value of property in Oregon is calculated. Tax bills which are. What months are real estate taxes due.

Business property statements are due. 4th Quarter Tax Due - 1st Monday of March. Contact Info Email Contact form Phone.

Unsecured tax bills in default if not paid by 500 pm. For now the September 1. And 1-12penalty added per month on any unpaid tax amounts.

An Earlier Deadline Some counties have an earlier deadline for. Each year the Property Tax Calendar is announced via a Letter To Assessors LTA. 1st Quarter Tax Due - 3rd Monday of August.

Be careful not to miss those deadlines as youll be charged a penalty of 10 and an interest of 15 for every month your payment is late. However you have until January 31st to pay without. In most counties property taxes are paid in two installments usually June 1 and September 1.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. You either pay your property taxes two or four times a year depending on the. Property taxes levied for the property tax year are payable in two installments.

If the tax bills are mailed late after May 1 the. How much is property tax in Long Island. Real Property Tax Payment Schedule Nevada.

In most counties property taxes are paid in two installments usually June 1 and September 1. The taxes are due by the following March 31. 3rd Quarter Tax Due - 1st Monday of January.

What months are real estate taxes due. The final Texas property tax due date is January 31st every year. What Months Are Oregon Property Taxes Due.

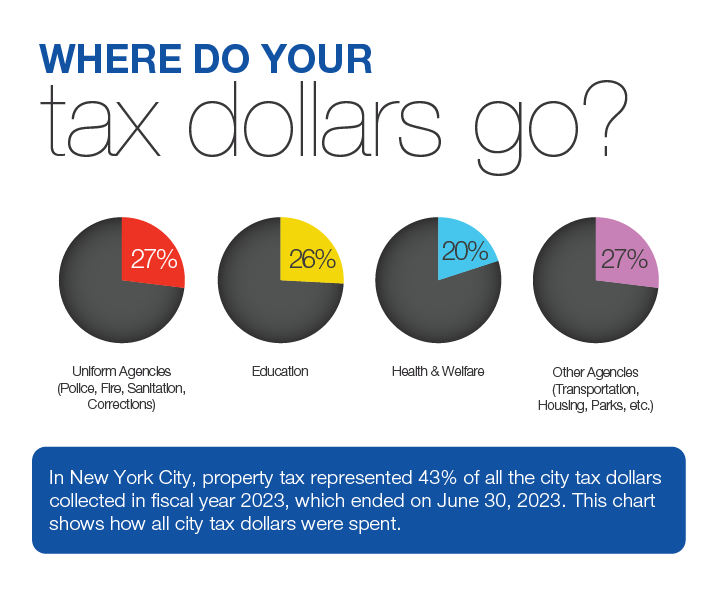

The fiscal year begins on July 1 and ends on June 30. Due Dates NYCs Property Tax Fiscal Year is July 1 to June 30. In most counties property taxes are paid in two installments usually June 1 and September 1.

Taxpayers who pay within the first 20 days will receive a 1 discount on the tax portion of their bill a perk that is shared by only a few counties in Georgia. The second installment is. Or close of business whichever is later to.

Property tax dates in DC are March 31 for the first and September 15 for the second instalment. Taxes are Due by December 20 Unless otherwise specifically stated in the law property taxes are due by December 20. Municipal County property tax bills Mailed in the beginning of January in most communities Payment deadlines vary in some municipalities and counties Valuation Date Valuation Date is.

The first installment of secured property tax is due on November 1st and becomes delinquent after December 10th. Finance mails property tax bills four times a year. If the tax bills are mailed late after May 1 the.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Technically your property taxes are due as soon as you receive a tax bill. In most counties property taxes are paid in two installments usually June 1 and September 1.

Are Illinois property taxes extended. Open All Close All January February March April. The LTA for Property Tax Calendar 2022 is No.

Property Tax Calendar If you have questions about any of the dates applications or programs listed below contact your county Assessors office. Property Tax Due Dates Property Tax Bills Property tax bills commonly called tickets are issued on or after July 15 of the property tax year by county sheriffs for all property except public. DC allows you to pay taxes by mail or online through its new payment system.

The first installment is due September 1 of the property tax year.

When Are Property Taxes Due For 2022 Spring Payment Youtube

When Are Property Taxes Due For 2022 Spring Payment Youtube

What The Gov Cook County Property Taxpayers Have Two Extra Months To Pay Their Bills Better Government Association

Prorating Real Estate Taxes In Michigan

New Jersey Sets One Month Grace Period For Property Taxes 2

Property Taxes And Your Mortgage What You Need To Know Ramsey

The Property Tax Annual Cycle Myticor

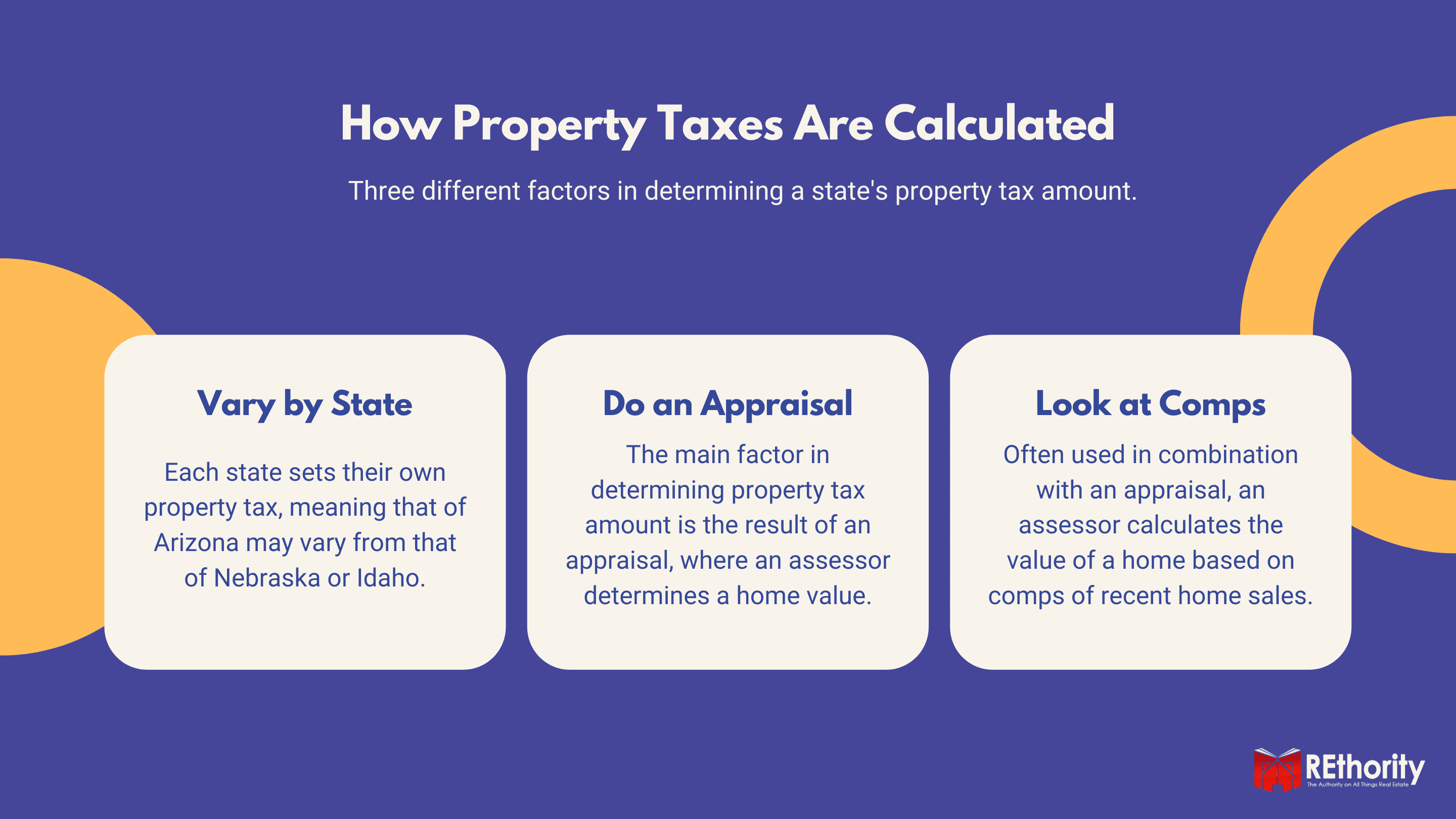

States With No Property Tax A Complete Guide Rethority

Property Tax Calculator Estimator For Real Estate And Homes

Unsecured Property Taxes Due Aug 31 2021

Property Taxes Historical Data Mn House Research

Understanding Your Property Taxes Golden Valley Mn

Wisconsin Policy Forum Investigating Residential Property Taxes

/GettyImages-929465592-11e776a2f7894a1896eb08a36c707348.jpg)

How To Pay Your Property Tax Bill

More Time To Pay Delinquent Property Taxes The City Of Hickory Hills Illinois

Your Guide To Property Taxes Hippo